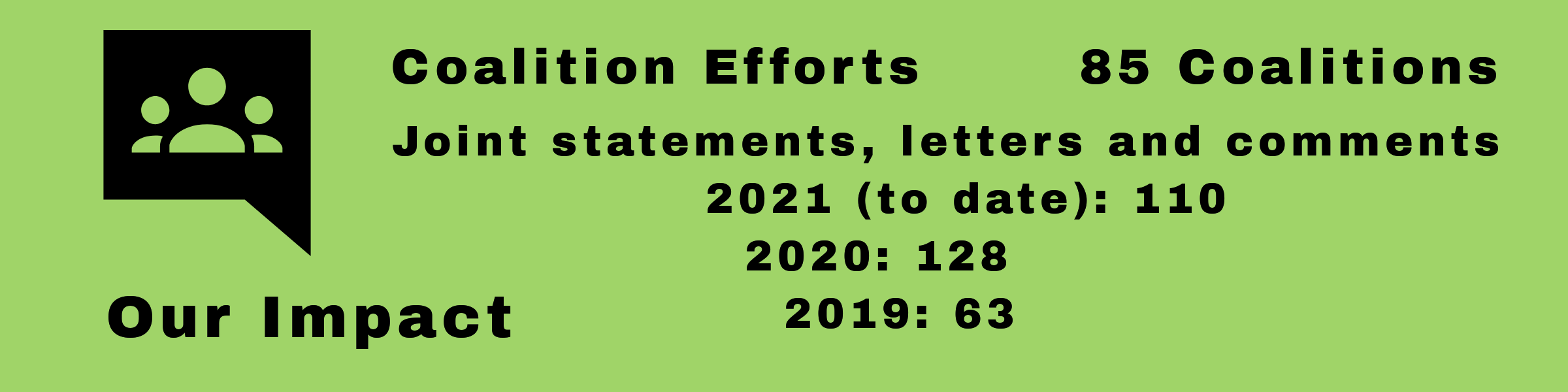

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Table of Contents

Postings

Coalition calls on Congress to expand FHLBank contributions to affordable housing programs

In a letter to congressional leaders, the Coalition for Federal Home Loan Bank Reform (CFR) called for action that would require FHL Banks to contribute at least 30% of their net income each year to support community development and affordable housing programs.

Advocates urge CFPB to require transparency for remittance fee disclosures

In a letter to the CFPB, advocates asked the Bureau to amend the Remittance Rule, which governs fees, disclosures, etc. on international remittances, so that the total cost of a remittance is transparent.

Organizations ask HUD to take steps to protect disaster relief for property owners lacking formal title

In a letter to HUD, consumer-interest organizations called on the agency to require states and localities receiving Community Development Block Grant Disaster Recovery funds to accept affidavits as proof of ownership in a property from homeowners applying for repair, reconstruction and relocation funds after a natural disaster.

Organizations weigh in on CFPB plan to mandate greater language assistance from mortgage loan servicers

In comments submitted to the CFPB, organizations expressed support for the agency’s efforts to improve the availability of language assistance to mortgage borrowers seeking loss mitigation assistance, and offered suggestions for improvement and smoother implementation.

Advocates comment on CFPB’s proposals to streamline loss mitigation procedures for struggling mortgage borrowers

Consumer and housing advocates submitted comments to the Consumer Financial Protection Bureau commending the agency’s efforts to make streamlined loss mitigation reviews for struggling mortgage borrowers a permanent option, while also offering suggestions.

HHS should allow for generic competition among Ozempic-like drugs to lower consumers’ drug prices

In a letter to Health and Human Services Secretary Xavier Bacerra, consumer-interest organizations called on the agency to use existing legal authority to allow competition for the diabetes and weight loss drugs Ozempic and Wegovy, which would lower prices for consumers.

Letter urges Department of Education to extend critical student loan borrower protections

Amid legal challenges to the Saving for A Valuable Education (SAVE) plan, advocates urged the Department of Education to ensure that servicers inform borrowers of their right to apply for SAVE and that they grant forbearance for all borrowers waiting in the pipeline—and that the forbearance time counts toward PSLF and IDR discharges. The groups also urged the Department to extend “on-ramp” protections and the “Fresh Start” program.

Advocates support legislation to enhance consumer artificial intelligence literacy

Advocates expressed support for legislation—the Consumer Literacy and Empowerment to Advance Responsible Navigation of AI (Consumers LEARN AI) Act—that would enhance consumer awareness of and confidence in the use of artificial intelligence products and services.

Advocates urge mark-up and vote on Forced Arbitration Injustice Repeal (FAIR) Act

In response to Disney’s attempt to quash a wrongful death lawsuit by invoking the forced arbitration clause in its Disney+ trial subscription, advocates urged Congress to mark up the Forced Arbitration Injustice Repeal (FAIR) Act (S 1376 and HR 2953), and to bring the legislation to a vote so that Americans can regain their fundamental right to justice through the court system.

Groups request consumer protections for energy-related home improvement loans tied to utility bills

Consumer advocates urged the CFPB and the FTC to issue guidance on TOB loans—financing extended to consumers for energy-related projects. The payments for these loans are placed on consumers’ utility bills without the protections required for installment debt. Nonpayment can result in the loss of essential utility service.